e-Invoicing Software in Mauritius

Get LHDN E-Invoicing Compliant with Microvista e-Invoicing Software

Microvista e-Invoicing software seamlessly aligns with LHDN's guidelines and is aimed at making your e-Invoicing implementation a breeze. As Mauritius's most sought-after solution, we ensure effortless compliance.

Electronic Invoicing Model in Mauritius

Why Microvista for e-Invoicing ?

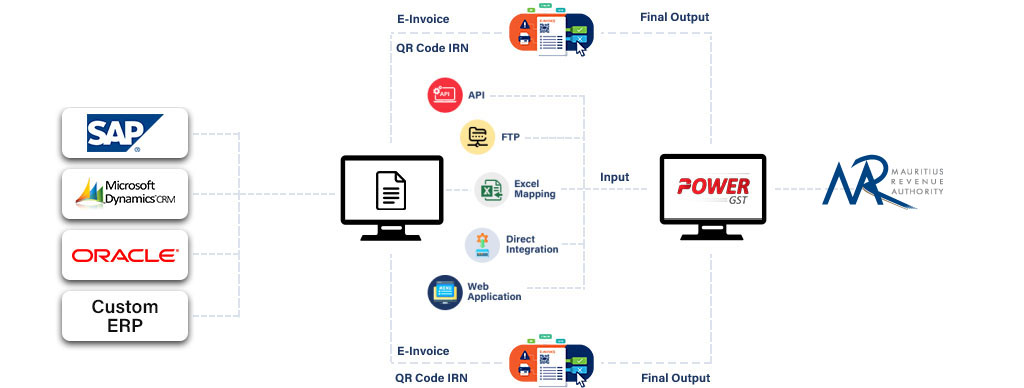

e-Invoice generation process through PowerGST

Frequently ask Questions

Want to ask something on e-Invoicing in Mauritius?

As of my last update, there may not be a mandatory requirement for e-Invoicing in Mauritius. However, businesses should stay informed about any updates or regulations issued by the relevant authorities.

While it may not be mandatory, voluntary adoption of e-Invoicing can bring benefits such as increased efficiency, reduced errors, and streamlined invoicing processes.

If e-Invoicing becomes a recommended or required practice, businesses can transition by selecting a certified e-Invoicing solution, ensuring compliance with regulatory standards, and implementing necessary changes to internal processes.

If e-Invoicing is regulated, businesses may need to adhere to specific standards. Checking with the Mauritius Revenue Authority or relevant regulatory bodies can provide details on the standards to be followed.

Governments often provide support or incentives to encourage e-Invoicing adoption. Checking with authorities or government announcements can provide information on any support programs.

If e-Invoicing becomes mandatory, there might be penalties for non-compliance. Understanding the regulatory framework and staying informed is crucial to avoid any potential penalties.

Implementing secure e-Invoicing solutions and following best practices for data security is essential. Businesses should choose reputable service providers and stay informed about security measures.

Request a Demo

For

Get in touch to discuss your project