Auto Fetching of GST, Income Tax &

TDS Notices

NoticeAlert - Auto Fetching of GST, Income Tax & TDS notices

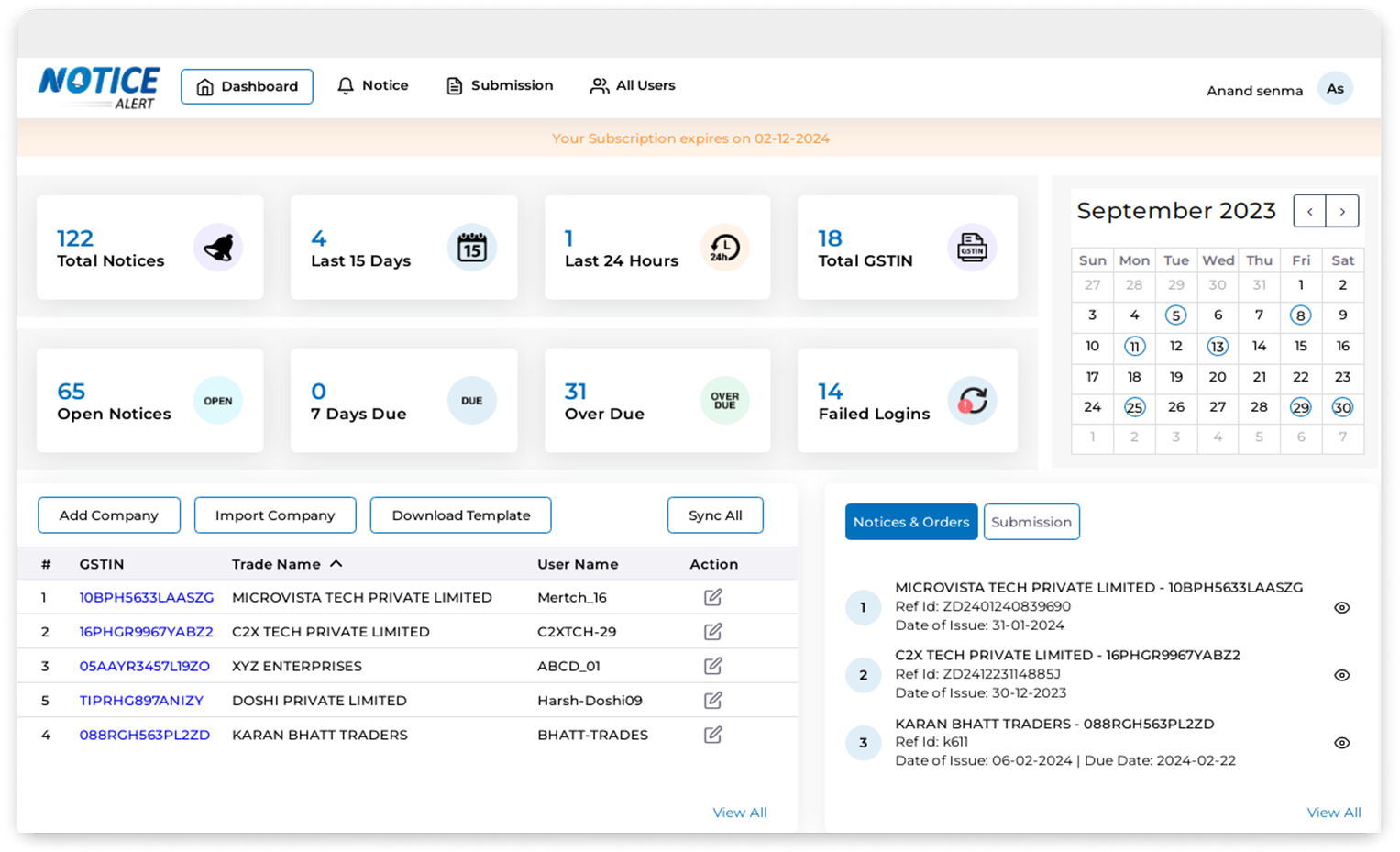

including Response, Deadlines & Stores in Centralized System

"Stay Informed, Stay Compliant: NoticeAlert Keeps You Ahead!"

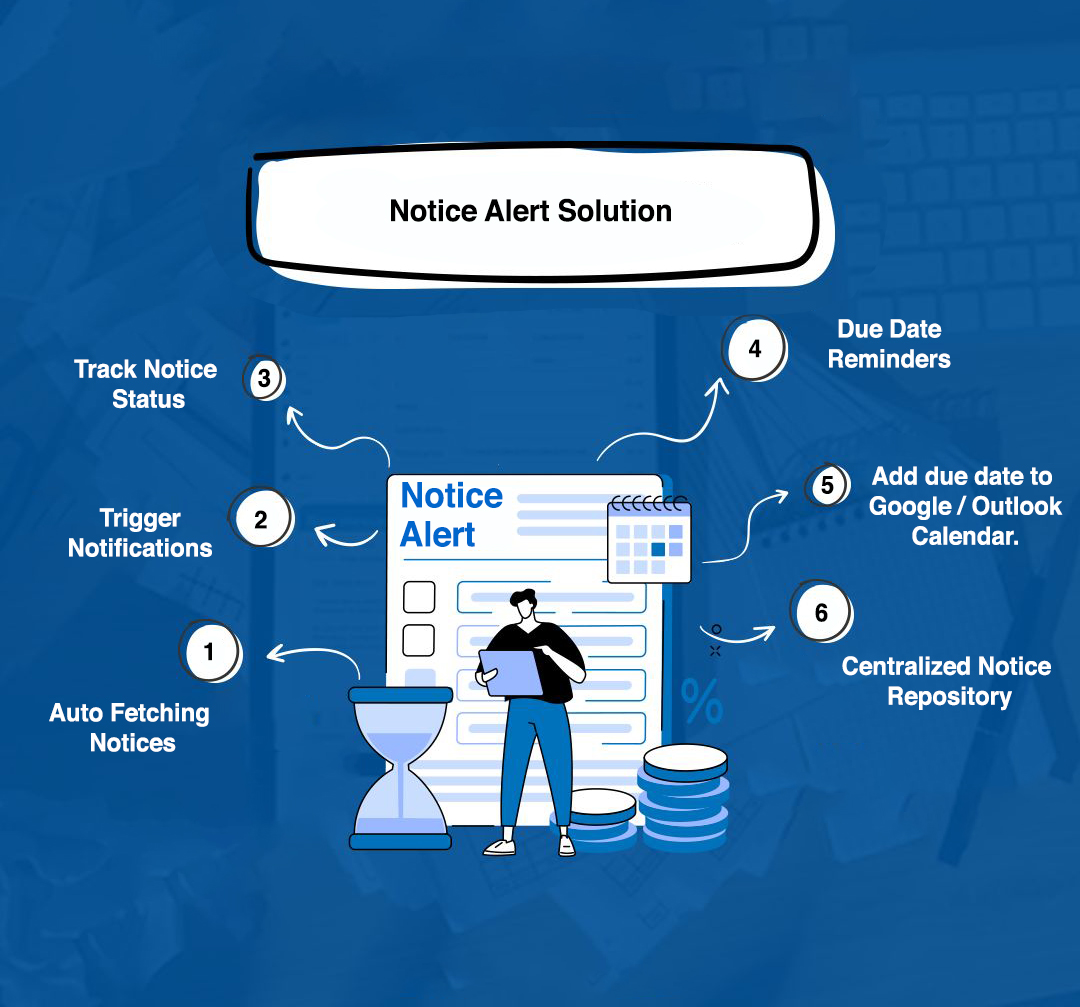

Features of

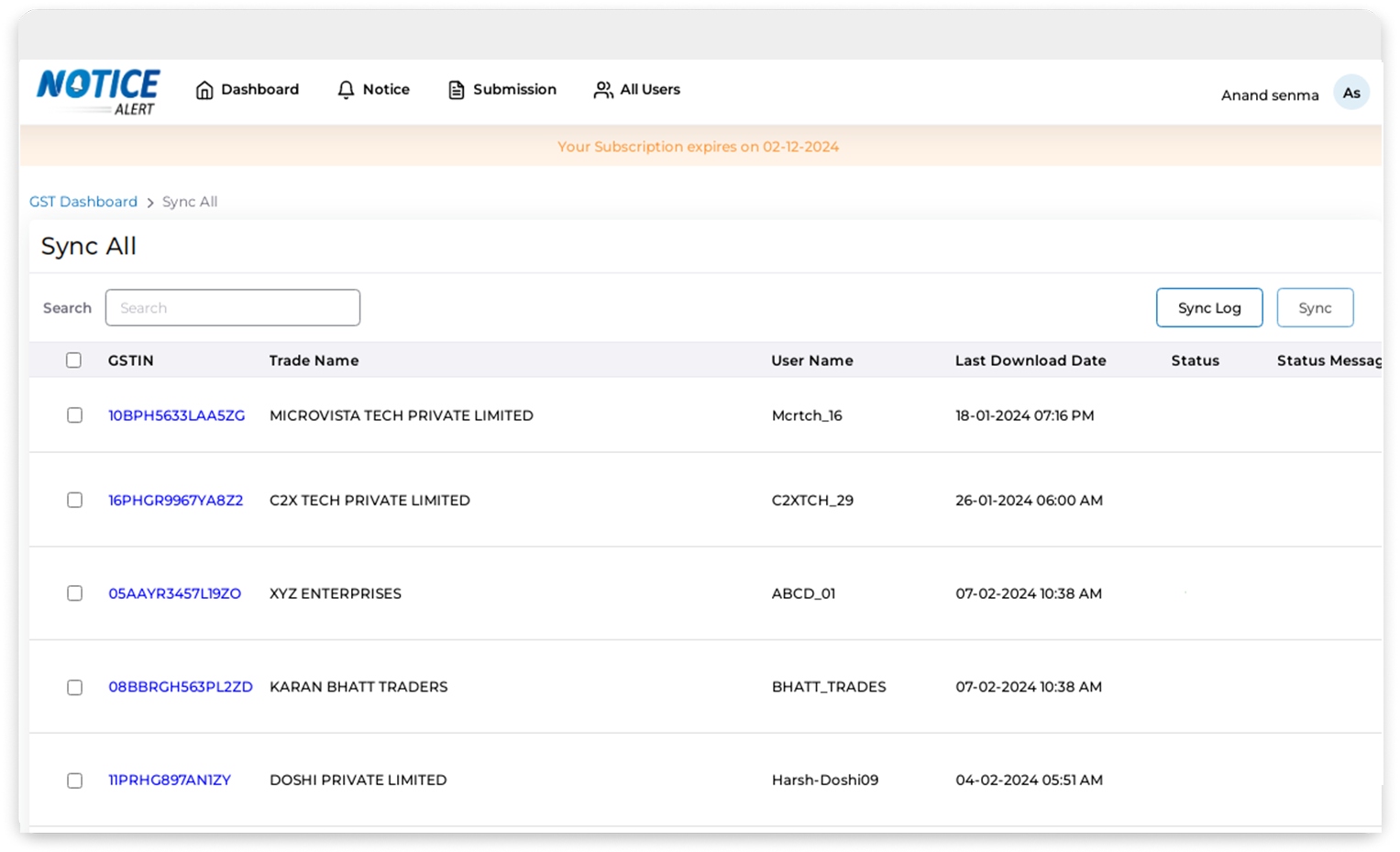

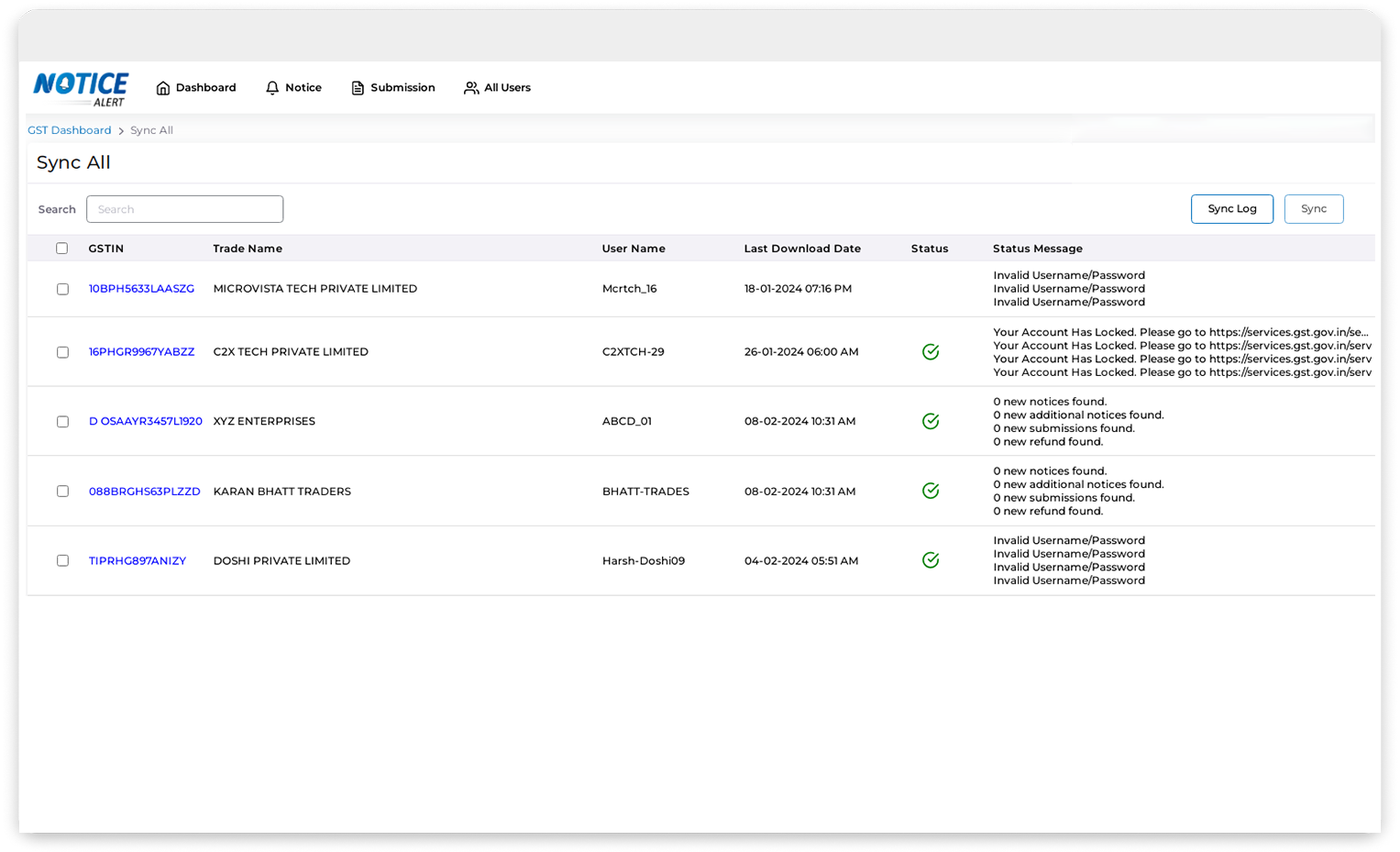

- Auto Fetching Notice from GST, Income tax & TDS Portal including Notices PDFs & Responses.

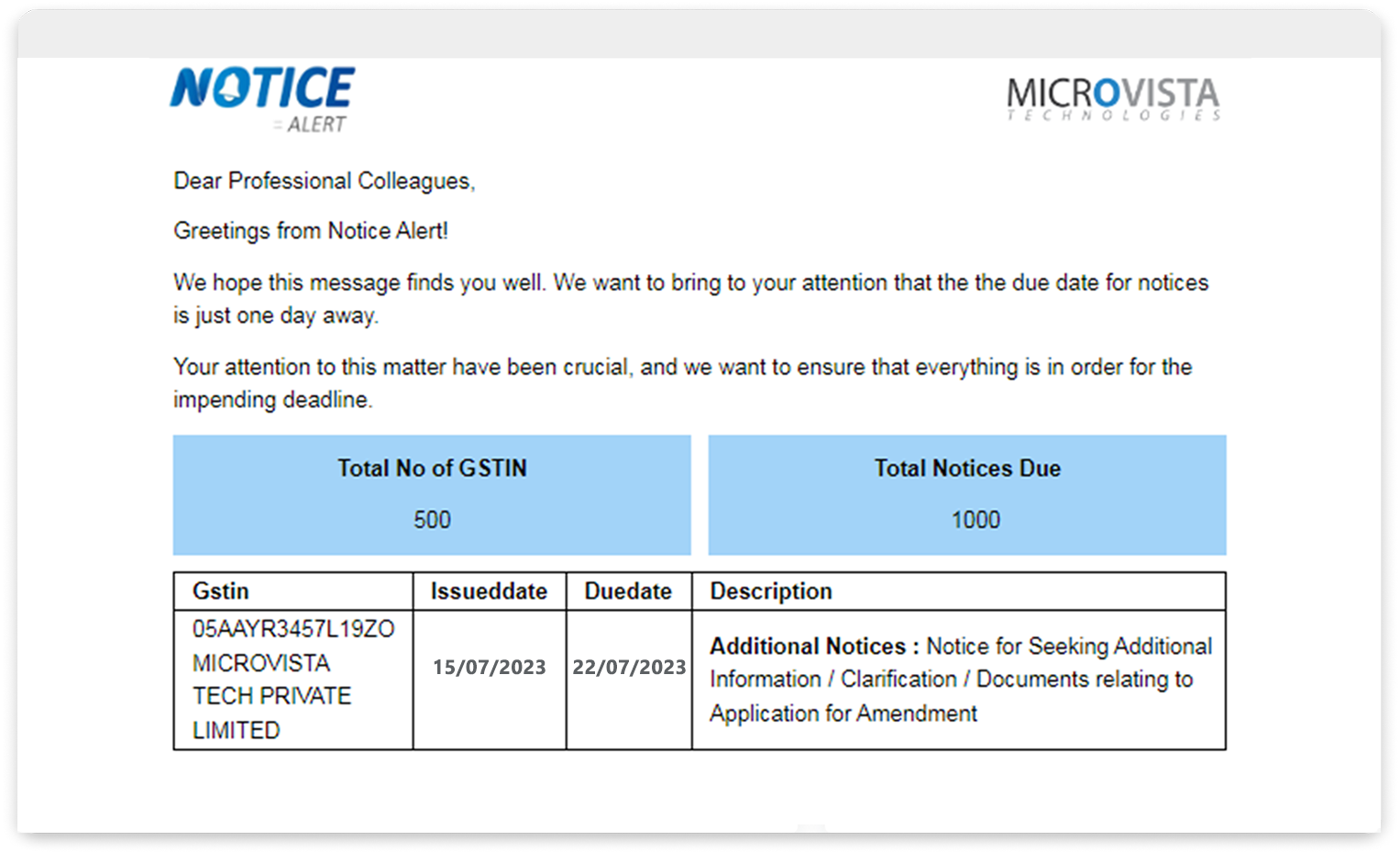

- Upon successful downloading of a notice, the system can trigger notifications or alerts to the designated recipients within the taxpayer's organization.

- It tracks the status of downloaded notices, including response deadlines and actions taken or pending.

- NoticeAlert is a centralized Notice Repository. Collate all notices on a single platform

- It send due date reminders to users

- Add due date, issue dates and compliance date to outlook & Google calendar.

How will NoticeAlert help you?

Features of Mobile Application

- Seamless Notice Download : Effortlessly download notices from the GST, TDS and Income Tax portals directly in our Application.

- Real-Time Notifications : Our application keeps you up-to-date with real-time alerts, so you can act promptly.

- Comprehensive Notice Access : Log in to your account to view detailed information about each notice, including downloadable PDF versions.

- Notice Management and Status Tracking : Efficiently manage your notices by tracking their status whether open, replied or closed.

FAQ's on

A GST Notice is an official communication issued by the tax authorities regarding the Goods and Services Tax Identification Number (GSTIN). It may contain important information or instructions related to your GST registration.

You may receive a GST Notice for various reasons, such as updates in GST regulations, compliance requirements, or specific issues related to your GST registration. It is essential to review the notice carefully to understand the nature of the communication.

GST Notices are typically sent electronically to the registered email address on the GST portal. You can access your notices by logging into the GST portal and navigating to the "Notices and Orders" section.

Upon receiving a GST Notice, carefully read the contents to understand the nature of the communication. If any action is required, follow the instructions provided in the notice. If clarification is needed, you may contact the relevant tax authorities.

Yes, if the notice requires a response or if you have concerns, you can respond to the notice within the stipulated timeframe. Failure to respond may lead to further actions by the tax authorities.

Ensure that your registered email address and mobile number on the GST portal are up-to-date. You can update these details by logging into the portal and navigating to the "Update Contact Details" section.

GST Notices may address issues such as non-compliance with filing requirements, discrepancies in returns, or requests for additional information. Each notice is specific to the nature of the issue.

Yes, seeking professional advice from a tax consultant or legal expert is advisable, especially if the notice involves complex issues. They can guide you on the appropriate response and ensure compliance with regulations.

Ignoring a GST Notice can lead to serious consequences, including penalties or suspension of your GST registration. It is crucial to address the notice promptly and take any necessary actions outlined in the communication.

For additional information, refer to the GST portal, official GST guidelines, or contact the GST helpdesk. Staying informed about GST regulations is essential for compliance.

Income tax notices are typically issued to address discrepancies, errors, or inconsistencies in your tax return filing. This could include issues such as underreported income, incorrect deductions claimed, or other tax-related matters.

Income tax notices are usually sent via mail to the address provided in your tax return. Some notices may also be communicated electronically through the income tax department's online portal or via email if you have registered for electronic communication.

If you receive an income tax notice, it's essential to read it carefully and understand the reason for its issuance. Take prompt action by reviewing your tax return and gathering any necessary documents or information to respond to the notice.

The timeframe to respond to an income tax notice is typically specified within the notice itself. It's crucial to adhere to the deadline provided to avoid any penalties or further action by the income tax department.

Yes, if you're unsure about how to respond to the income tax notice or need assistance in understanding the issues raised, you can seek help from a tax professional, accountant, or legal advisor. They can provide guidance based on your specific situation.

If you disagree with the information or findings in the income tax notice, you have the right to provide a response clarifying your position and providing any supporting documentation or evidence. It's essential to communicate your concerns clearly and accurately to the income tax department.

Ignoring an income tax notice can lead to further action by the income tax department, including penalties, fines, or even legal proceedings. It's crucial to address the notice promptly and take appropriate action to resolve any issues raised.

Responding to the income tax notice after the specified deadline may result in penalties or adverse consequences. It's essential to adhere to the timeframe provided in the notice and respond promptly to avoid any negative repercussions.

In some cases, you may be able to request an extension to respond to the income tax notice if you require additional time. However, this is subject to the discretion of the income tax department, and you must provide valid reasons for the extension request.

To ensure compliance with the income tax notice, carefully review the notice, gather all relevant documents and information, seek professional advice if needed, and respond to the notice within the specified timeframe. It's essential to provide accurate and complete information to the income tax department to resolve any issues raised effectively.

Microvista Tax litigation software is a specialized tool designed to assist businesses, tax professionals, and legal teams in managing tax-related legal matters efficiently. It provides features to streamline case management, document handling, communication, and collaboration throughout the tax litigation process.

In the challenging world of tax compliance, disputes are both time-consuming and costly. Tax Litigation Management Software has emerged as a powerful solution to tackle these challenges by simplifying case management, organizing documentation, and enabling seamless collaboration.

Common features of tax litigation software include case tracking and management, document management, calendar and deadline management, task management, communication tools, integration with tax compliance systems and legal research databases, reporting and analytics, and security and compliance measures.

By providing tools to streamline and optimize the tax litigation process, tax litigation software helps users to navigate complex tax disputes more efficiently, reduce administrative burdens, mitigate risks, improve communication and collaboration, and ultimately achieve more favorable outcomes for their clients or organizations.

Tax litigation software is designed to handle a wide range of tax-related legal matters, including disputes, audits, appeals, and litigation processes. However, the suitability of the software may vary depending on the specific requirements and complexity of the tax dispute in question.

The ease of implementation and use of tax litigation software can vary depending on the specific software solution and the user's familiarity with similar tools. Many software providers offer training, onboarding assistance, and ongoing support to help users get up to speed quickly and maximize the benefits of the software.

TDS Notice Management Software is a specialized tool designed to help businesses and individuals efficiently handle Tax Deducted at Source (TDS) notices from tax authorities. It simplifies the process of managing, responding, and tracking TDS-related communications and ensures timely compliance with tax regulations.

The software usually includes a built-in calendar and notification system that tracks deadlines for filing responses. It sends automated reminders well in advance of the due date to avoid penalties or interest charges due to late filings.

Yes, many TDS Notice Management Software solutions offer integration capabilities with popular accounting and ERP systems, such as Tally, QuickBooks, or SAP. This ensures that all financial and TDS data remains in sync across platforms.

TDS Notice Management Software is designed to handle multiple notices simultaneously. It can categorize them by type, date, or urgency, making it easier for users to prioritize and respond to notices in a timely manner.

Yes, many advanced TDS Notice Management Software tools offer bulk notice processing features, allowing businesses or tax professionals to manage and respond to multiple notices at once, saving considerable time and effort.

Yes, most solutions allow users to generate detailed reports for audit purposes. These reports include records of notices received, responses filed, and compliance status, which can be used during internal or external audits.