GST Verification API

Integrate GST Verification API with your application to validate GST taxpayer details. GST Verification API will help you verify any GSTIN on a real-time basis. Integrate the APIs with your ERP and verify the GSTIN within seconds.

What is GST Verification API?

Indian Goods and Services Tax Act was implemented in July 2017, replacing many indirect taxes. The GSTIN is a completely unique number assigned to businesses registered under this Act.

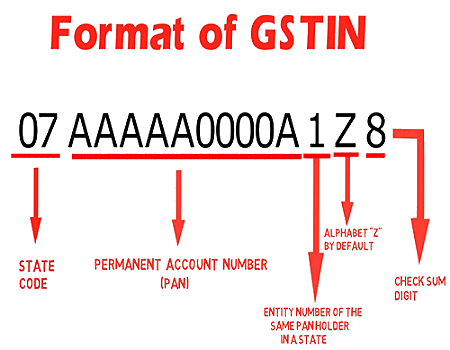

GST Verification API is a web-based application programming interface (API) that allows businesses to verify their customers' or vendors' GSTIN (Goods and Services Tax Identification Number). This API is used to verify the GSTIN number of a customer or vendor, which is a unique 15-digit number assigned to every registered taxpayer in India. It helps businesses to ensure that the GSTIN provided by the customer or vendor is valid and genuine by verifying it online instantly, thus avoiding any fraudulent activities.

Search Taxpayer using our GST Verification API.

- PAN / State / Status

- GSTIN of the Tax Payer

- State Jurisdiction Code

- Legal Name of Business

- State Jurisdiction

- Taxpayer type

- Nature of Business Activity

- Legal Name of Business

- Address of Principal Place of Business

- Address of Additional Place of Business

- Date Of Cancellation

- Last Updated Date

- Date of Registration

- Constitution of Business

- Registration trade name

- GSTN status

- Centre Jurisdiction Code

- Centre Jurisdiction

- Nature of Principal Place of Business

- Nature of Additional Place of Business

- Date of Filing

- Return Type

- Tax Period Selected by User

- ARN Number Generated After Filing

- Mode of Filing (OFFLINE/ONLINE)

- Is Return Valid/Invalid ?

Benefits of our GST Verification API

Let’s connect to Integrate Microvista’s GST Search API with your existing software to validate GST of your taxpayer details.

- Provides complete and most accurate static details related to the Taxpayers.

- Verified the legal name of the Taxpayer.

- Customers are extremely satisfied.

- Onboarding new vendors becomes extremely easy and quick.

- Easy and seamless GST verification API Integration with other accounting softwares.

- Fraudulent activities reduce to null.

- Customers are extremely satisfied.

Power GST Mobile Application GSTIN Search & Return Status

- Get details of any GSTIN

- Get Return status details of any GSTIN

- No need to type GSTIN or enter Captcha

- Identify Fake GST Numbers

- Share GSTIN result with anyone

- History tab to revisit searched GSTINs

Search Taxpayer using our GST Number Verification API

Microvista’s cloud based GST Verification API makes search and verification of GST numbers extremely easy.In this verification API, you just need to enter the GSTIN number and our GST Search API will give you the correct and accurate details about the Taxpayer associated with that particular GST number.

This GST Search API can be used by small, medium or large scale taxpayers. Microvista’s GST Verification API integrates and works effortlessly with any of the Accounting softwares or ERP and verifies the GSTIN in real time!

Get access to your GSTIN verification API now from Microvista Technologies. Contact today.

Frequently ask Questions

FAQs about GST Verification API

GST number verification API or GST API is a system or application interface that gives the fast, accurate and verified GST details about the vendors and companies that are registered under the GST. Our API is the most efficient and trusted GST API that makes the whole system of validate onboard for your company.

Our GST verification API system helps you to get the verified accurate GST details of the suppliers, vendors, companies & Customers whether they are real or fraud. Chances of fraud occurring is minimal. Our GST verification API is the need of the hour for GST compliances. It easily works/integrates with the company's current ERPs or accounting systems.

To get the GST results from the GSTIN Verification API system, you only need to enter the GST number of the other company whom you want to verify. Our GST API will bring the data from the government GSTIN department’s database/repositories. This entire process happens in real time.

Our GSTIN verification API is very accurate with almost zero chances of errors in verifying or validating the details of the company. The data fetched from the government GST system is double checked with the GST department. Therefore, the GSTIN verification API is almost error free.

This GST verification API provides real time/ instant results.

Only a GST number is needed for this API to work and provide GST details.

Microvista’s online GST Verification API is a very fast, accurate and GST API that fetches quick and authentic GST details of the companies. This GST API works well for all sizes of companies/enterprises. Microvista’s GST Verification API integrates very effortlessly and easily with your current and existing ERP and verifies the GSTIN within a few seconds, that is, in real time! Contact today.

You can just to fill a quick small form on this page - https://www.microvistatech.com/gst-verification-api

Our expert GST Verification API software developers have developed this GST API that shall make your whole process of verifying GSTIN of companies very easy and automatic.

- It fetches all the needed information regarding a GSTIN accurately.

- It easily validates GST details from ERP or CRM.

Yes, it's very easy to work with our GST Verification API.

Email - support@microvistatech.com.

Call - +91 70167-11841 / +91 97731 38204 /+91 79-26460445

The cost of using the GST Verification API is typically based on the number of API calls or requests made. Some providers may offer tiered pricing plans based on usage levels.

Pay-As-You-Go: You pay for each API call or request made.

If you exceed your API call limit, you may be charged an additional fee per extra call, or you may need to upgrade to a higher plan. The specific terms will depend on your API provider's pricing policy.

Request a Demo

For

Get in touch to discuss your project,