Most Popular GST Software in India for GST Return Filing

"India's Most Trusted & Fastest GST Return Filing Software!"

- Experience the Most Trusted and Fastest GST Return Filing Software!

- Discover our advanced GST return filing software, offering seamless reconciliation of Purchase and GSTR 2A / 2B invoices and automated data validation for effortless compliance.

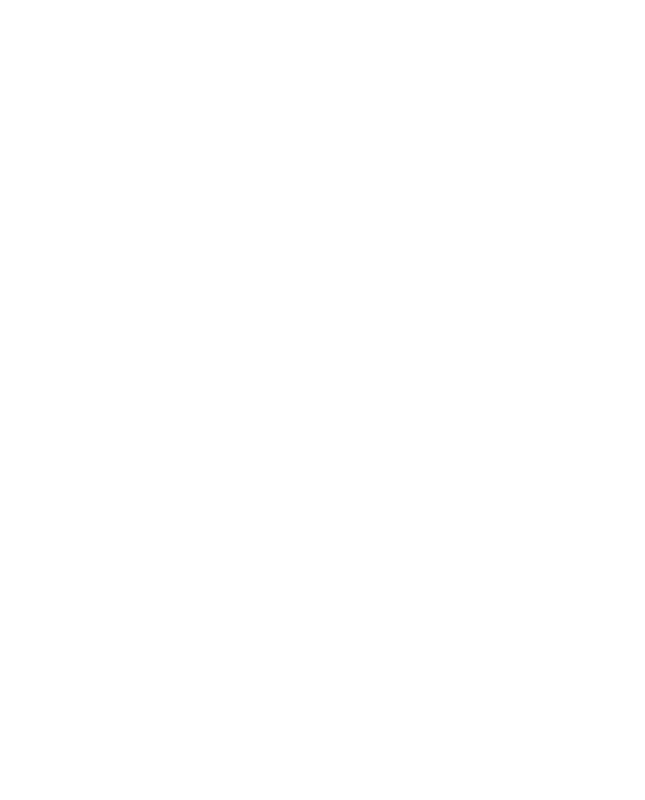

GST Software Features

Best GST Software for GST Return Filing, Reconciliation & Reporting

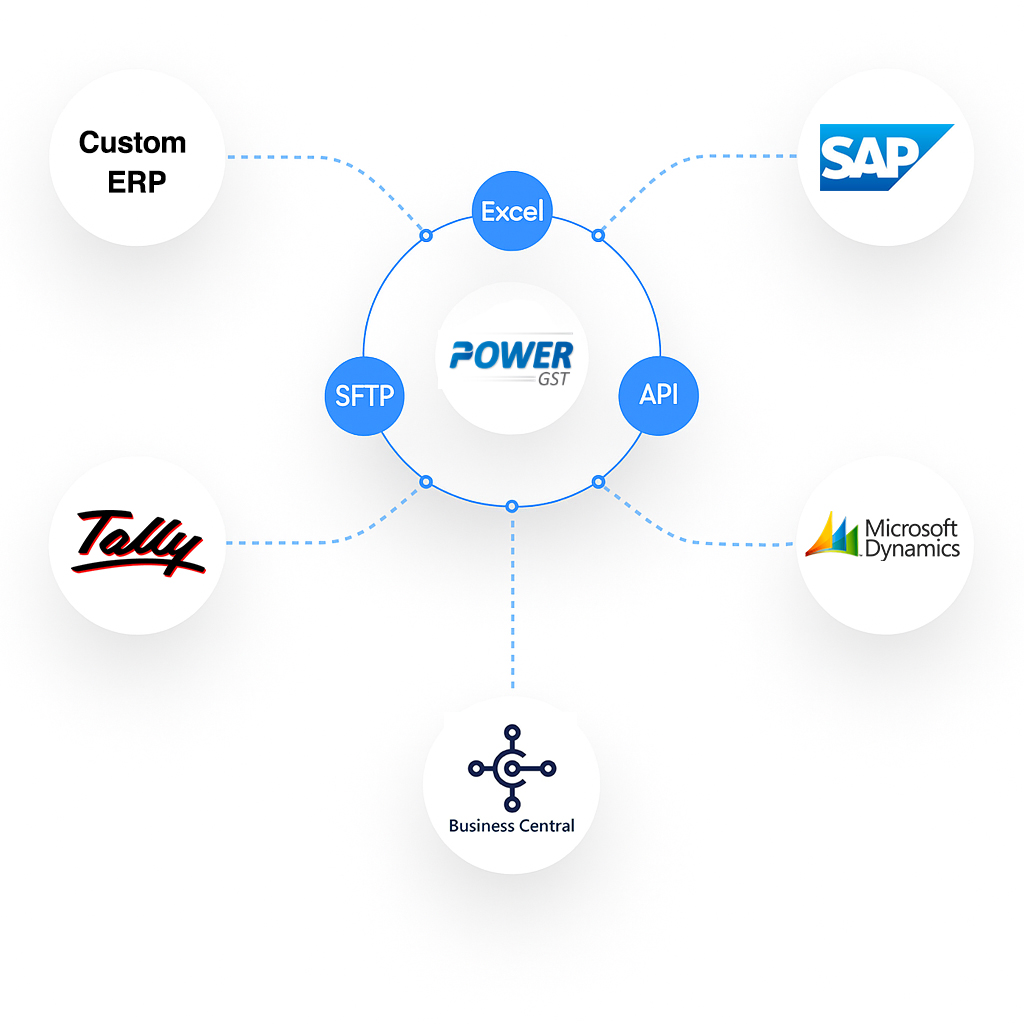

Seamlessly Import Data directly from any ERP System.

"We support seamless integration for importing data with all major ERP platforms, including SAP, Microsoft, Tally, and others."

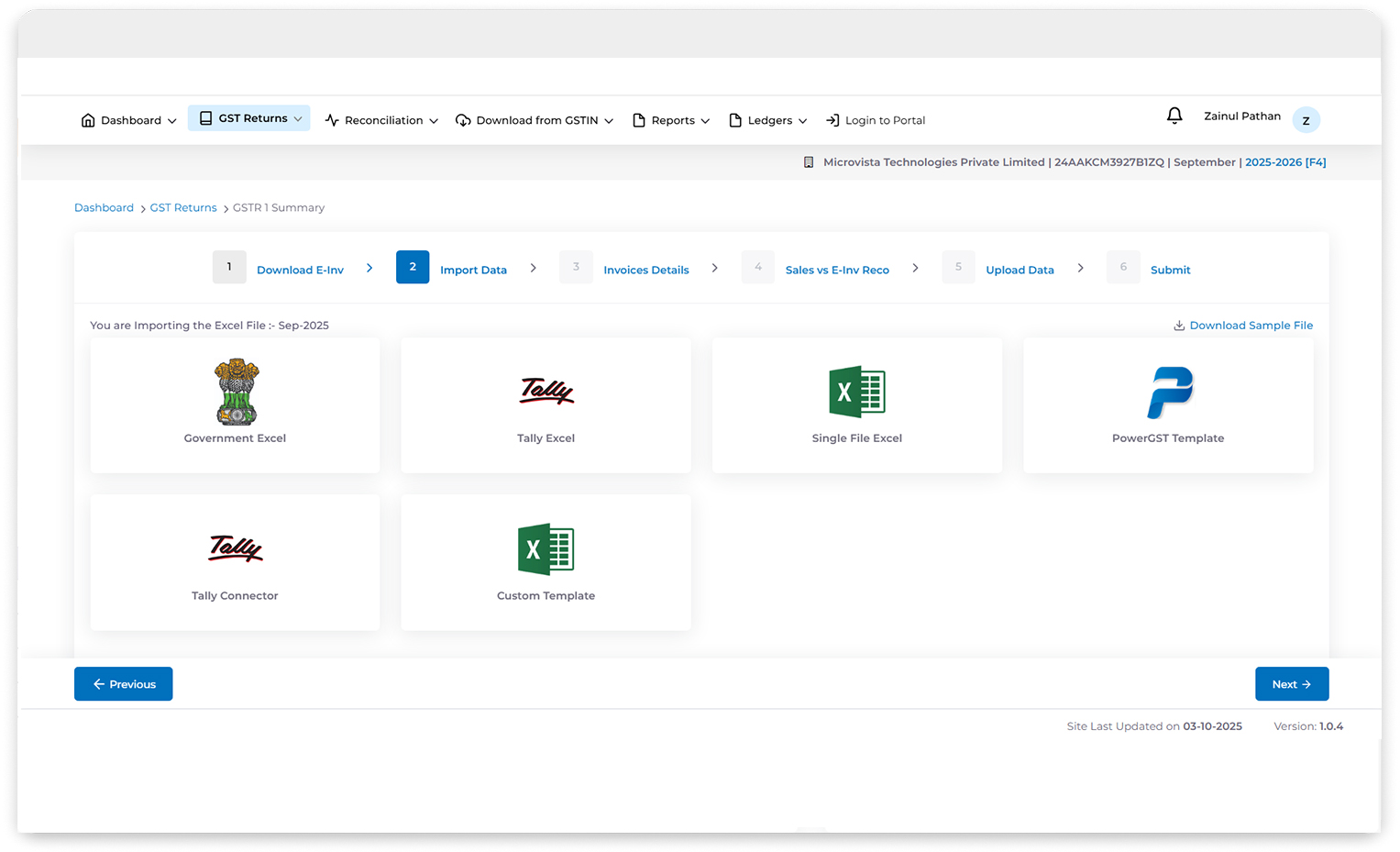

We offer enhanced import options, including a Government template, Tally Excel, and our custom Single File template.

Connectors & Templates

Import data with connectors or custom excel based templates of your choice or fill directly on the interface.

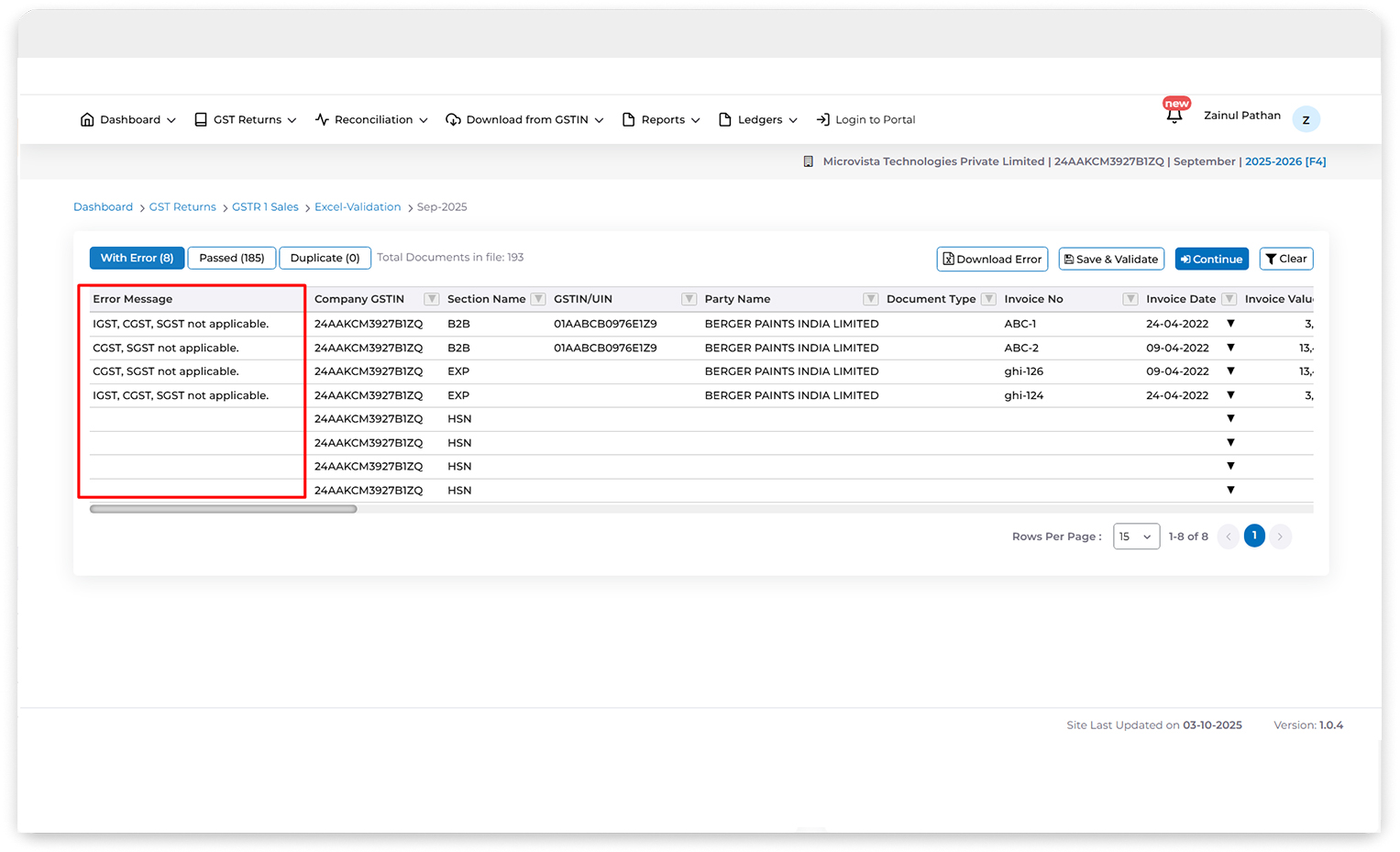

Data Validations & accuracy.

We run robust validation before importing any data in sales and purchase to reduce any error while filing hence improving efficiency and building confidence to file correct and accurate data.

GSTR Filings

Experience a faster and more efficient way to file GSTR 1 to 9, streamlining your tax reporting process and saving your valuable time

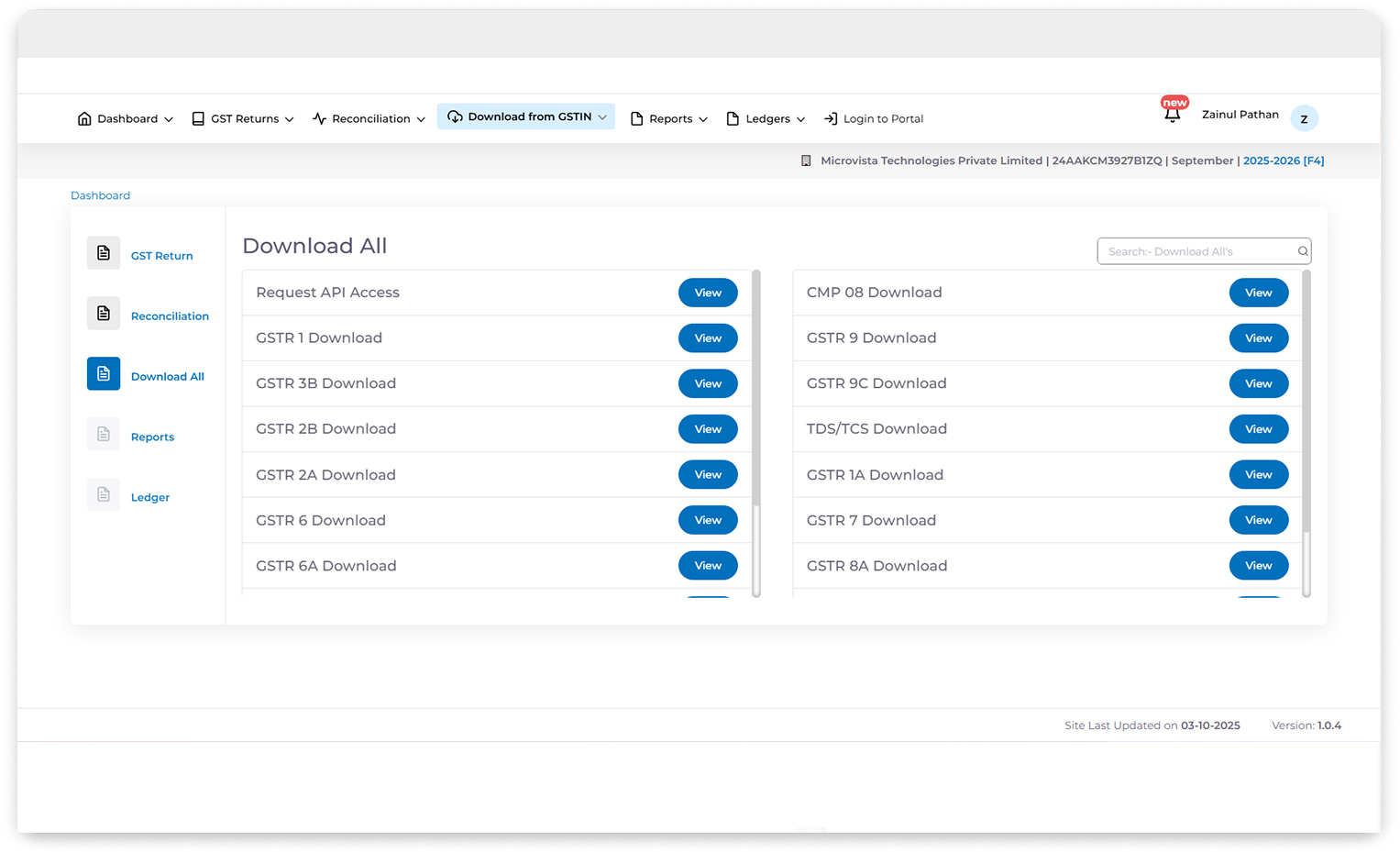

Download Filed returns/GSTR2A/2B in fractions of seconds

Retrieve GSTR-2A, GSTR-2B, and filed GSTR-1 and GSTR-3B invoices for multiple companies and for multiple Months and Years at once seamlessly in single click.

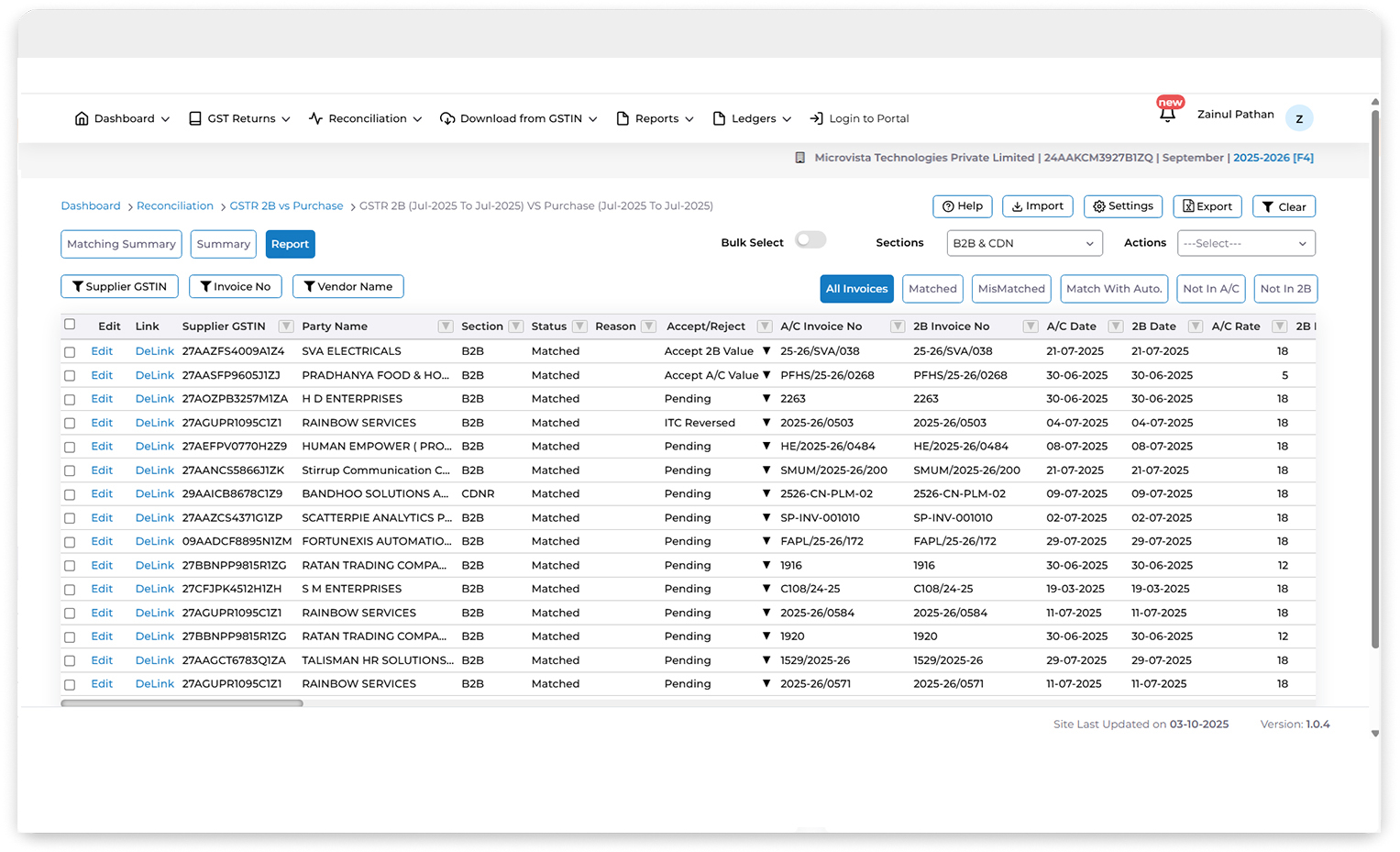

Advanced Reconciliation

Get Automated matched reconciliation for unlimited no of invoices in minutes with AI - Powered insights

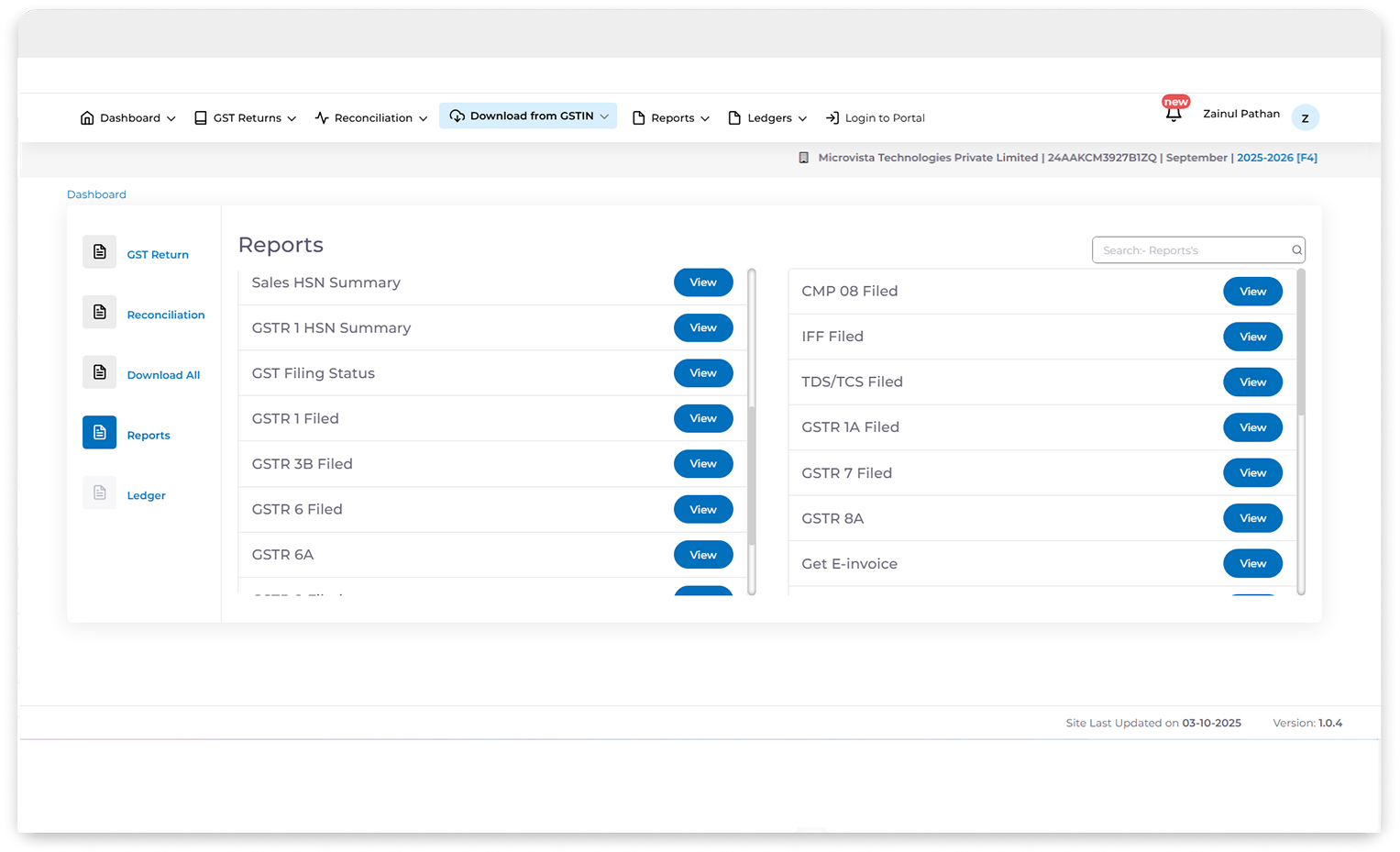

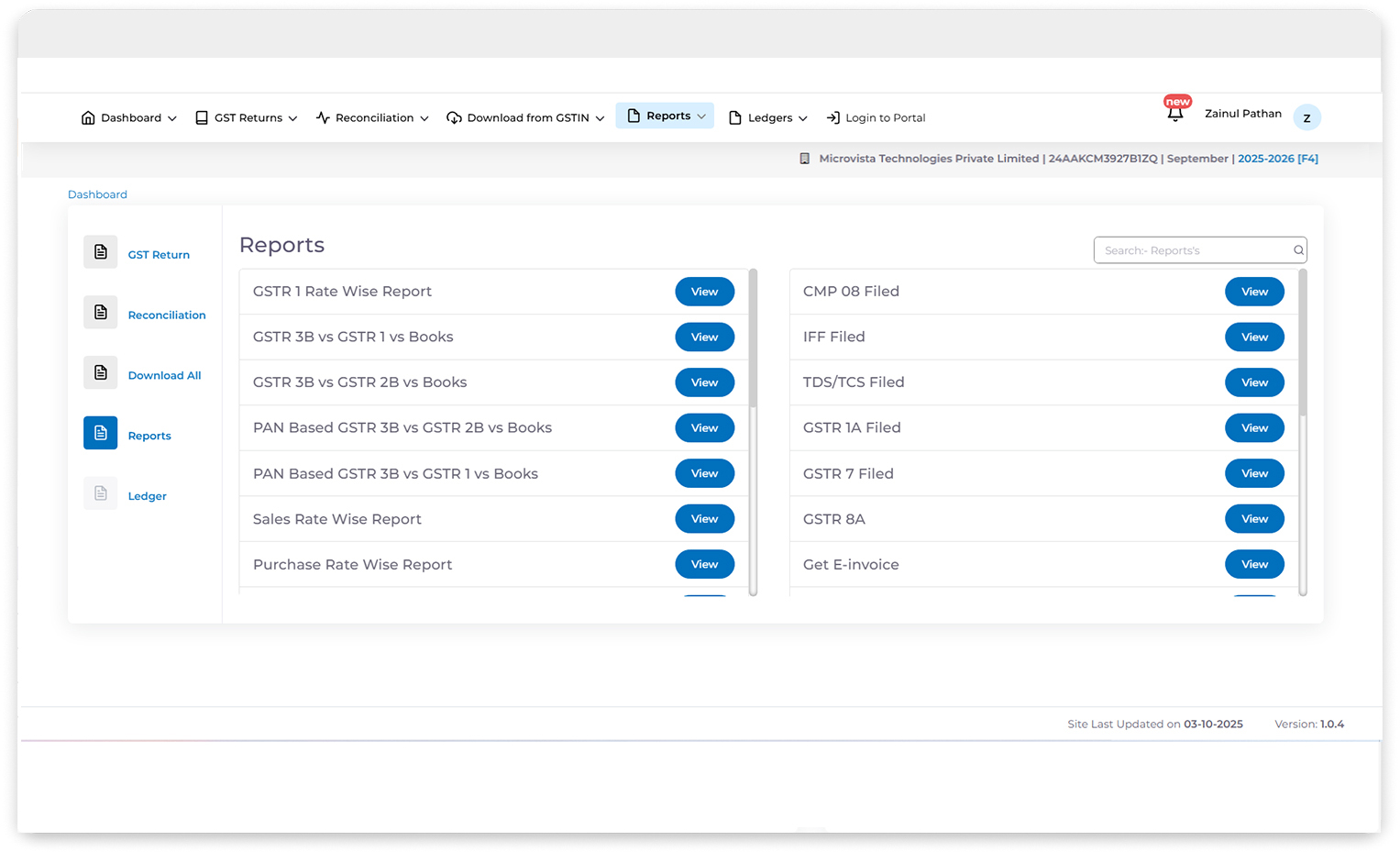

Insightful Reports

Create Insightful reports for your clients by analyzing GST Returns and invoices from any historical period. Access detailed balances of credit and cash ledgers and receive comprehensive summaries by HSN, suppliers and more.

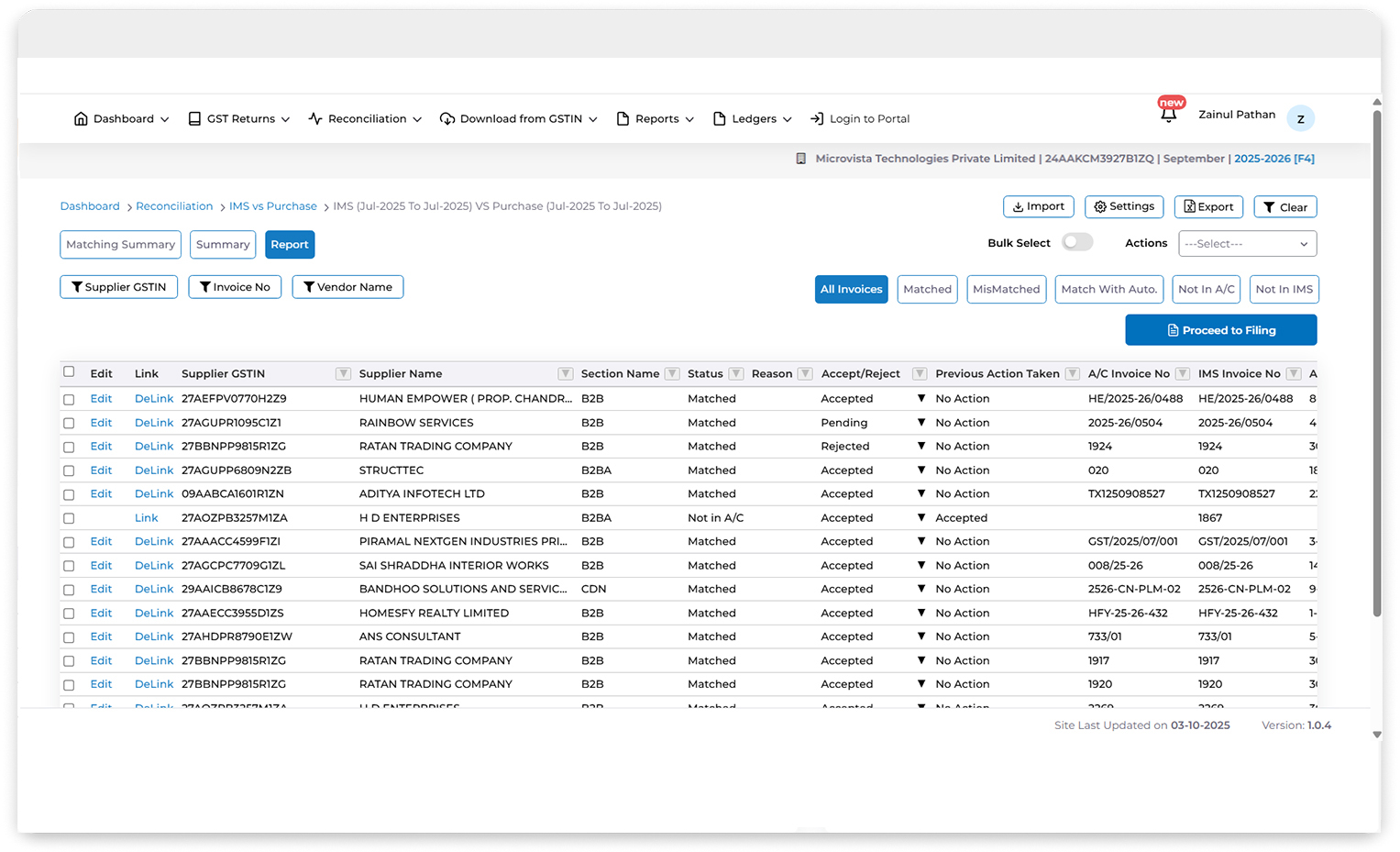

IMS Reconciliation

Reconcile your purchase data with IMS

PAN Level Reports and Data Facility for multiple GSTIN business

Import all data at GSTIN or Pan Level effortlessly and accurately.

Never miss any tax credit by matching invoices by suppliers under multiple GSTINs for PAN

PowerGST Mobile Application GSTIN Search & Return Status

- Get details of any GSTIN

- Get Return status details of any GSTIN

- No need to type GSTIN or enter Captcha

- Identify Fake GST Numbers

- Share GSTIN result with anyone

- History tab to revisit searched GSTINs

FAQ's on GST Software?

GST software is a type of tax compliance software designed to help businesses in India manage and file their Goods and Services Tax (GST) returns.

GST software can benefit businesses by automating the process of calculating, recording, and reporting GST, reducing the risk of human error, providing real-time visibility into GST liability, and streamlining the tax compliance process.

Yes, GST software systems offer integration with accounting software, allowing for seamless transfer of data between the two systems and reducing manual data entry.

Yes, GST is mandatory for all businesses in India that meet the specified thresholds for annual turnover and/or type of goods or services sold.

Electronic signatures refer to any electronic mark indicating a person's agreement to a document or message, while digital signatures are a specific type of electronic signature that uses encryption algorithms to verify the signer's identity and the integrity of the data.

GST reconciliation refers to the process of matching and comparing the data reported in various GST returns and invoices to ensure accuracy and consistency. It involves reconciling the data from different sources, such as e-invoices, GSTR-1, GSTR-2A, and GSTR-2B, with the aim of identifying and rectifying any discrepancies

GST reconciliation software is a specialized tool or application designed to automate and streamline the process of GST reconciliation. It helps businesses compare and reconcile data from various GST returns and invoices, saving time and effort that would otherwise be spent on manual reconciliation.

GSTR-2A reconciliation involves reconciling the data in the GSTR-2A form with the purchase invoices uploaded by the suppliers. GSTR-2A is an auto-generated return that reflects the purchases made by a taxpayer as per the invoices uploaded by their suppliers.

GSTR-2B reconciliation involves comparing the data in the GSTR-2B form with the purchase invoices uploaded by the suppliers. GSTR-2B is an auto-drafted return that provides a summarized view of the input tax credit (ITC) available based on the invoices uploaded by the suppliers.

GST reconciliation is important because it helps ensure the accuracy and consistency of the data reported in GST returns and invoices. By reconciling the data, businesses can identify and rectify any discrepancies, prevent potential compliance issues, and claim the correct input tax credit.

Using GST reconciliation software offers several benefits, such as: Automation and streamlining of the reconciliation process. Reduction of manual errors and increased accuracy. Time savings by eliminating the need for manual data matching. Identification of discrepancies and potential compliance issues. Improved efficiency in claiming accurate input tax credit.

GST reconciliation should ideally be performed on a regular basis, preferably monthly or quarterly, to ensure timely identification and rectification of any discrepancies. Regular reconciliation helps maintain accurate records, prevents accumulation of errors, and facilitates smoother GST return filing.

If you find discrepancies during GST reconciliation, you should investigate the causes of the discrepancies. Check for errors in data entry, missing invoices, incorrect tax calculations, or any other potential issues. Once identified, rectify the discrepancies and make the necessary amendments in your GST returns or invoices before filing them.

GSTR-1 reconciliation involves comparing the data reported in the GSTR-1 return with the invoices issued by a taxpayer. It helps identify any discrepancies between the two, such as missing or incorrect entries, and enables the taxpayer to rectify them before filing the return

GST return filing is the process of submitting details of business transactions, including sales, purchases, and tax payments, to the tax authorities as per the Goods and Services Tax (GST) regulations.

Businesses registered under GST are required to file regular GST returns. This includes entities such as manufacturers, suppliers, wholesalers, retailers, service providers, and e-commerce operators.

The frequency of GST return filing depends on the type of taxpayer and the nature of their business activities. Most businesses are required to file monthly, quarterly, or annually, based on their turnover and registration type.

A GST return typically includes details of taxable sales (outward supplies), purchases (inward supplies), input tax credit availed, tax liability, and tax payments. It also involves reconciling the data with the previous period's return and correcting any discrepancies.

Failure to file GST returns on time may result in penalties and fines imposed by the tax authorities. Additionally, non-compliance with GST regulations could lead to legal action, suspension of GST registration, and disruption of business operations.

GST returns can be filed online through the GST portal (www.gst.gov.in) using a registered account. Businesses can manually enter the details or use accounting software that is compatible with the GSTN (Goods and Services Tax Network) portal to generate and upload the return files.

Certain categories of taxpayers, such as small businesses and composition scheme dealers, may have simplified compliance requirements or reduced frequency of return filing. However, it is essential to stay updated on the latest GST regulations to ensure compliance.

Businesses can seek assistance from tax professionals, chartered accountants, or GST practitioners for guidance on GST compliance, return filing procedures, and resolving any issues or queries related to GST returns. Additionally, resources such as the GST portal, help desks, and official documentation provide valuable information and support.

GST billing software is a digital tool designed to automate and streamline the process of generating invoices and managing billing operations while ensuring compliance with Goods and Services Tax (GST) regulations.

Any business that is registered under GST and is required to issue invoices for goods or services supplied can benefit from using GST billing software. This includes manufacturers, wholesalers, retailers, service providers, and e-commerce sellers.

Common features of GST billing software include invoicing, automatic GST calculation, invoice customization, item management, customer management, reporting and analytics, integration with accounting software, multi-user access, automated reminders, security features, and scalability.

GST billing software automatically calculates GST (CGST, SGST/UTGST, IGST) based on the nature of the transaction, place of supply, and applicable tax rates. It generates invoices that include all required GST-related information, such as GSTIN, HSN/SAC codes, and tax amounts, to ensure compliance with GST laws.

Yes, GST billing software is suitable for businesses of all sizes, from small startups to large enterprises. The software can be customized to meet the specific needs and scale of the business, making it adaptable and versatile.

Yes, many GST billing software solutions offer integration with accounting software, ERP systems, e-commerce platforms, and payment gateways. Integration allows for seamless data synchronization, improved efficiency, and enhanced workflow automation.

GST billing software is designed to be user-friendly and intuitive, with features such as customizable templates, drag-and-drop functionality, and step-by-step wizards to simplify the invoicing process. Many software providers also offer training, tutorials, and customer support to help users get started quickly.

When choosing GST billing software, businesses should consider factors such as their specific invoicing requirements, budget, scalability, integration capabilities, user interface, customer support, and reviews from other users. It's essential to select a software solution that aligns with the business's goals and objectives.

List of Popular GST software in India includes:

Our Products

Our Solutions

APIs

Request a Demo

For

Get in touch to discuss your project,