E-Invoicing in UAE

Be Ready for the 2026–27 Mandate

Microvista Technologies e-Invoicing Software UAE is fully aligned with the Federal Tax Authority (FTA) guidelines and built to simplify your PEPPOL-based e-Invoicing journey. As one of the most reliable and business-friendly solutions, we make your FTA compliance seamless, fast, and future-ready.

Why This Platform Matters

Why Businesses Should Act Now

UAE E-Invoicing Timeline (Mandatory Phases)

How UAE E-Invoicing Works

Why Microvista for e-Invoice in UAE ?

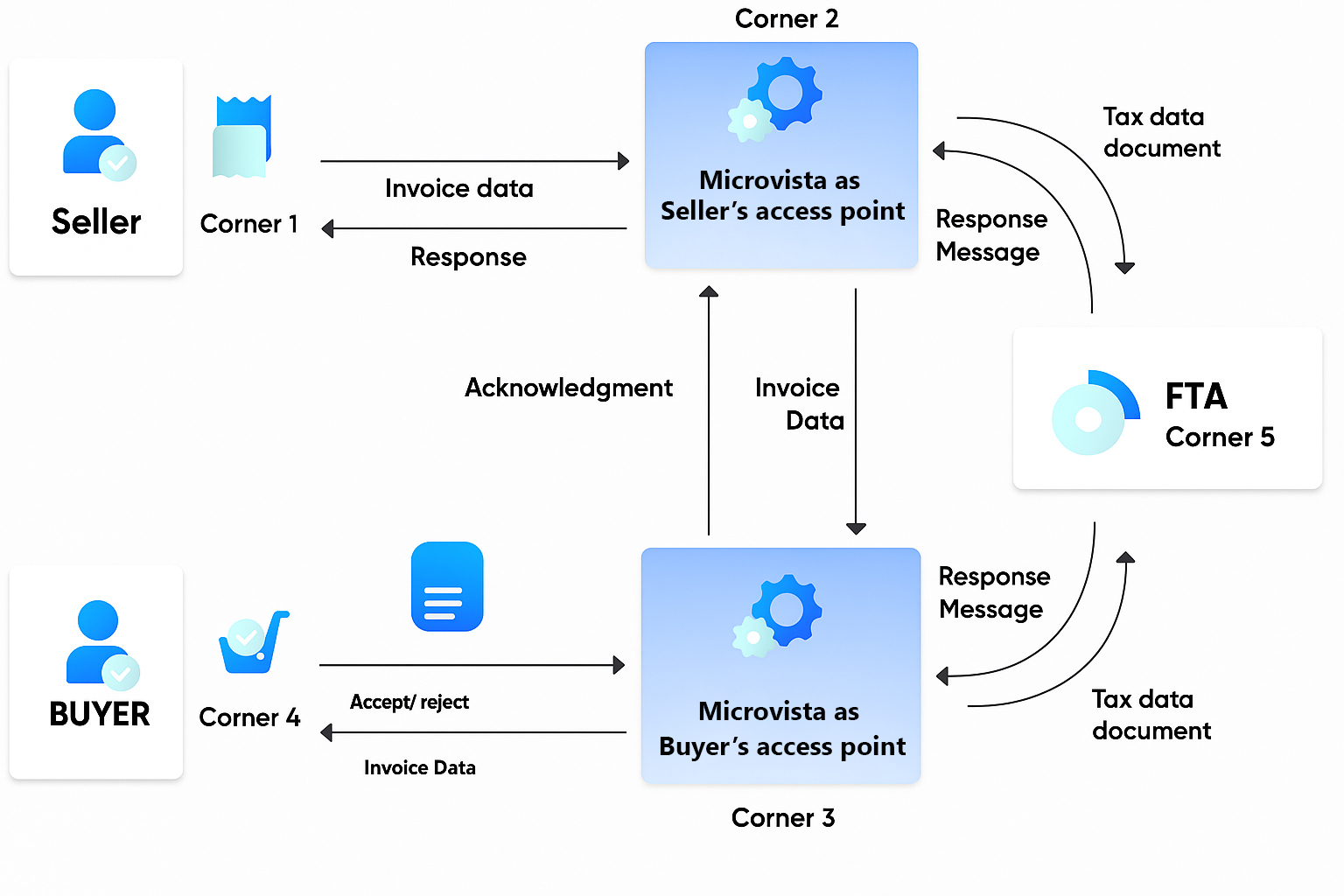

e-Invoice generation process in PEPPOL

Frequently ask Questions

Want to ask something on e-Invoicing in UAE?

E-Invoice software is a digital solution that generates, transmits, and stores invoices in a structured electronic format compliant with government regulations. It ensures real-time validation, secure exchange, and seamless integration with tax authorities and business systems.

Benefits include cost savings, faster invoice processing, reduced errors, improved transparency, and better compliance with regulatory requirements.

Businesses can adopt e-Invoicing by selecting a certified e-Invoicing solution provider, registering with the necessary authorities, and integrating the chosen solution into their invoicing processes.

The Federal Tax Authority (FTA) is the official regulatory body responsible for overseeing the implementation, compliance, and monitoring of the e-Invoicing process in the UAE.

UAE has adopted the Peppol (Pan-European Public Procurement Online) framework as the standard for e-Invoicing. It facilitates interoperability between different e-Invoicing platforms.

Yes, e-Invoicing can benefit small businesses by reducing manual processes, minimizing errors, and improving overall efficiency in the invoicing cycle.

The UAE government has introduced initiatives to encourage e-Invoicing adoption, and businesses should explore potential incentives or support programs.

Request a Demo

For

Get in touch to discuss your project